If traditional budgeting feels like a chore, the 50/30/20 rule might be the breath of fresh air you need. Instead of tracking every single expense or juggling endless categories, this method offers a simple structure to help you manage your money without the overwhelm. It’s straightforward, easy to follow, and flexible enough to adapt to real life, making it a perfect fit for anyone who dreads budgeting but still wants financial clarity.

Understanding the 50/30/20 Breakdown

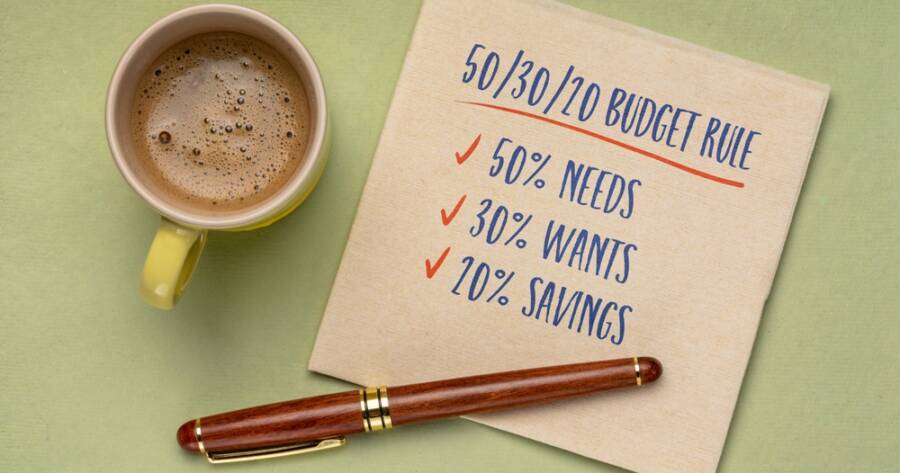

The 50/30/20 rule divides your after-tax income into three main categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. It’s a streamlined framework that helps you see where your money should go without requiring hours of spreadsheet work. By sticking to this structure, you can keep your finances balanced while still enjoying your life.

Needs include essentials like rent, groceries, and utility bills. Wants to cover things like dining out, streaming services, and travel. The final 20% is where your financial progress happens, like building savings, tackling credit card debt, or investing in your future. This breakdown ensures you’re covering your bases while still leaving room for fun and growth.

Identifying What Counts as a ‘Need’

One of the biggest challenges with the 50/30/20 rule is knowing how to correctly categorize your spending. Needs are often misunderstood. They’re not just anything you want badly, but true essentials for daily living. This includes housing, minimum loan payments, groceries, insurance, and transportation to work.

Being honest about what qualifies as a need helps prevent overspending in this category. Cable subscriptions, premium gym memberships, or fancy meal kits may feel essential, but they usually fall under wants. Tightening your definition keeps your budget on track and ensures your core expenses are truly covered first.

Giving Yourself Room for Fun Without Guilt

The beauty of the 30% “wants” category is that it gives you freedom, without sabotaging your goals. You can buy concert tickets, splurge on your favorite skincare brand, or enjoy takeout guilt-free, as long as it fits within your limit. This balance makes it easier to stick with the budget long-term because it doesn’t feel like constant deprivation.

People often give up on budgeting because they go too extreme and eliminate all enjoyment. The 50/30/20 rule avoids that trap. By intentionally setting aside money for fun, you can embrace your lifestyle and still stay on top of your finances. It’s about spending smarter, not cutting out everything you love.

Making the Most of the 20% Toward Goals

The final 20% of your income might not be the largest portion, but it’s the one that builds security and financial freedom. This category includes savings, emergency funds, investments, and extra debt payments. If you’re starting from scratch, focus first on building an emergency fund before tackling debt or long-term savings.

Automating this portion of your paycheck can make sticking to it nearly effortless. Even small amounts add up over time, especially when consistently saved or invested. This part of your budget is all about future you—giving yourself options, reducing stress, and preparing for unexpected life events without going into crisis mode.

When to Adjust the Rule to Fit Your Reality

While the 50/30/20 rule is a great starting point, life isn’t one-size-fits-all. High rent costs, medical bills, or caregiving responsibilities might push your “needs” beyond 50%. That’s okay. The key is to stay flexible and use the rule as a guide, not a rigid law. It can still work with slight adjustments to better suit your situation.

If your wants are minimal, you might decide to divert more toward savings. Or if you’re aggressively paying off debt, you might pull from the wants category temporarily. The goal is to build awareness and intention into your spending, not to box yourself into something unsustainable. Customizing the rule makes it even more powerful.

A Simpler Way to Stay Financially Balanced

Budgeting doesn’t have to be complicated to be effective. The 50/30/20 rule works because it’s built for real life, giving you structure without micromanagement. It helps you cover what matters most, enjoy your lifestyle, and build a future without burnout. Whether you’re new to budgeting or tired of detailed spreadsheets, this rule offers an approachable way to take control of your finances while still enjoying the ride.